In the global financial landscape, banks engage in transactions with clients, businesses, and governments across various countries. However, the ability of a bank to undertake transactions with certain countries is subject to a wide range of factors, including international regulations, trade agreements, diplomatic relations, and sanctions imposed by global or regional entities.

When a bank considers conducting transactions with a specific country, it must ensure compliance with both domestic regulations (such as Central Bank and RBI guidelines in India or the Federal Reserve in the US) and international financial rules.

In this article, we will explore the factors that determine whether a bank can undertake transactions with certain countries and the circumstances under which such transactions might be restricted or prohibited.

1. Factors Affecting Bank Transactions with Foreign Countries

1.1 International Sanctions

One of the most significant factors that impact a bank’s ability to conduct transactions with a particular country is the presence of sanctions. Sanctions are punitive measures imposed by countries or international organizations such as the United Nations (UN), European Union (EU), or United States to restrict trade, financial transactions, or diplomatic relations with certain countries.

- Economic Sanctions: These can include restrictions on trade, freezing assets, or limiting access to international financial markets.

- Banking Restrictions: Sanctions may prevent banks from directly or indirectly engaging in transactions with individuals, corporations, or governments from certain countries.

- Primary and Secondary Sanctions: Primary sanctions are directly imposed on the country, while secondary sanctions are imposed on entities or individuals doing business with the sanctioned country.

For example, countries like North Korea and Iran are subject to severe international sanctions that restrict their ability to conduct financial transactions globally. Banks are generally prohibited from engaging in transactions involving these countries unless they comply with very specific exemptions granted by the sanctioning authority.

1.2 Compliance with Anti-Money Laundering (AML) Regulations

Banks must ensure that they comply with Anti-Money Laundering (AML) and Counter-Terrorism Financing (CTF) laws, which prevent money laundering and the funding of illegal activities, including terrorism.

- Know Your Customer (KYC): Before engaging in cross-border transactions, banks must conduct thorough due diligence to ensure the legitimacy of the parties involved. This includes understanding the origin of funds and ensuring that the transaction is not intended for illegal activities.

- Banks are typically cautious about engaging in financial transactions with countries or regions that have been identified as high-risk jurisdictions for money laundering or terrorism financing.

1.3 Diplomatic Relations and Bilateral Agreements

Banks often rely on diplomatic relations between countries and bilateral agreements on trade and financial cooperation. If two countries have positive diplomatic ties and trade agreements, banks in those countries are more likely to engage in financial transactions, such as trade financing, remittances, or investments.

For instance, countries that are part of the World Trade Organization (WTO) often have trade and financial arrangements that facilitate banking transactions. On the other hand, countries with strained diplomatic relations may face restrictions on financial exchanges.

1.4 Currency Control and Exchange Restrictions

Some countries have strict currency control regulations that limit the ability of individuals or businesses to exchange their domestic currency for foreign currencies. This can impact a bank’s ability to undertake cross-border transactions with that country.

- Countries that impose heavy capital controls or have non-convertible currencies may limit the flow of funds in and out of the country. For example, countries like Argentina and Venezuela have had currency controls that make it difficult for banks to facilitate smooth transactions with them.

Banks in these countries may need special permission from their central banks or governments to engage in foreign transactions, which can create delays or restrictions in international dealings.

1.5 Global Financial Networks and Access to SWIFT

The Society for Worldwide Interbank Financial Telecommunication (SWIFT) is a global messaging network that facilitates secure and standardized international financial transactions. Countries that have been banned or restricted from accessing the SWIFT network cannot engage in international transactions as efficiently.

- Iran, for example, has been disconnected from the SWIFT network at various times due to sanctions, making it extremely difficult for banks in Iran to engage in cross-border financial transactions.

- Similarly, North Korea has faced restrictions that limit its access to international banking networks.

2. Countries with Restricted Banking Transactions

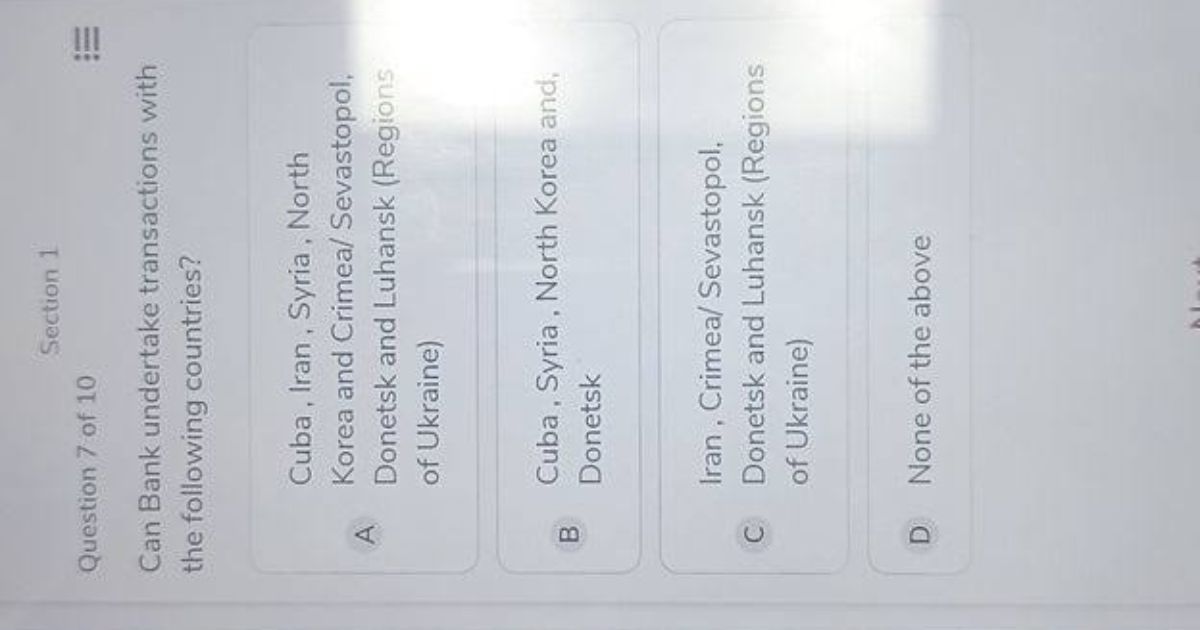

While the list of countries that face restrictions varies based on international policies, some countries are consistently restricted or sanctioned due to political reasons, non-compliance with international financial regulations, or involvement in illegal activities. Some of the well-known countries facing such restrictions include:

2.1 North Korea

- Sanctions: North Korea is subject to strict international sanctions, particularly from the United Nations and the United States, due to its nuclear weapons program and human rights violations.

- Impact on Banking: North Korean entities are generally excluded from the global banking system, making it almost impossible for banks to engage in financial transactions involving North Korean individuals or businesses.

2.2 Iran

- Sanctions: Iran faces heavy sanctions from the United States and other western countries due to its nuclear program and alleged support for terrorism.

- Impact on Banking: Many banks around the world are reluctant to engage in transactions with Iranian entities because of the risk of violating international sanctions. While some relief has been provided under certain agreements, banks must exercise caution when dealing with Iranian transactions.

2.3 Syria

- Sanctions: Syria is subject to UN and US sanctions due to its involvement in conflicts and human rights abuses.

- Impact on Banking: Similar to North Korea and Iran, Syrian financial institutions and individuals face severe restrictions, limiting the ability of banks to facilitate transactions with Syria.

2.4 Cuba

- Sanctions: Although Cuba has seen some easing of US sanctions in recent years, it still faces restrictions that limit financial transactions, especially in the US banking system.

- Impact on Banking: Cuban banks and financial institutions continue to face restrictions on international transactions, particularly with countries that have stringent US sanctions.

2.5 Venezuela

- Sanctions: Venezuela has been subjected to economic sanctions by the United States and other countries due to its political instability and economic crises.

- Impact on Banking: Venezuelan financial institutions and businesses face challenges accessing the global banking system due to restrictions and sanctions, making it difficult for banks to engage in transactions involving Venezuela.

3. Conclusion

In conclusion, whether a bank can undertake transactions with a particular country depends on a variety of factors, including sanctions, diplomatic relations, AML and CTF regulations, and currency control policies. While countries with positive diplomatic and trade relations tend to have smoother financial interactions, banks must adhere to international legal and regulatory frameworks to avoid violations.

In cases where sanctions or restrictions are in place, banks must proceed with caution and ensure they comply with all relevant regulations before engaging in transactions with these countries. For example, banks may need to adhere to strict due diligence and KYC (Know Your Customer) requirements to ensure compliance with international laws.

Ultimately, the ability to undertake transactions with certain countries is heavily influenced by the global political landscape and the compliance requirements imposed by national and international authorities.